World

Investment Report 2015 - Overview -

25 Jun 2015, 581.1 KB

Preface, Key

Messages and Overview - 14 Pages, 221KB

Report is particularly timely in light of the Third

International Conference on Financing for Development in Addis Ababa – and the

many vital discussions underscoring the importance of FDI, international

investment policy making and fiscal regimes to the implementation of the new

development agenda and progress towards the future sustainable development

goals.

The World Investment Report tackles the key challenges in

international investment protection and promotion, including the

right to regulate, investor-state dispute settlement, and investor responsibility.

Furthermore, it examines the fiscal treatment of international investment,

including contributions of multinational corporations in developing countries,

fiscal leakage through tax avoidance, and the role of offshore investment links.

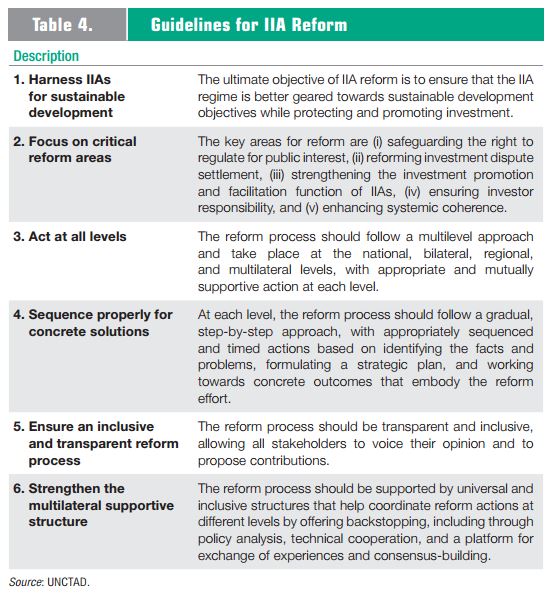

The Report offers a menu of options for the reform of the

international investment treaties regime, together with a roadmap to

guide policymakers at the national, bilateral, regional and multilateral

levels. It also proposes a set of principles and guidelines to ensure coherence between

international tax and investment

policies.

CHAPTER I Global

Investment Trends - 28 Pages, 1873KB

Global foreign direct investment (FDI) inflows fell by

16 per cent in 2014 to $1.23 trillion, down from $1.47

trillion in 2013. The decline in FDI flows was influenced

mainly by the fragility of the global economy, policy

uncertainty for investors and elevated geopolitical

risks. New investments were also offset by some large divestments. The decline in FDI flows was in contrast

to growth in GDP, trade, gross fixed capital formation

and

employment (table I.1).

CHAPTER II

Regional Investment Trends -

72 Pages, 5617KB

Global foreign direct investment (FDI) inflows fell by

16 per cent overall in 2014 to $1.23 trillion, down from

$1.47 trillion in 2013, but with considerable variance -

between country groups and regions.

FDI flows to developing economies increased by 2

per cent to reach their highest level at $681 billion

in 2014, accounting for 55 per cent of global FDI inflows

(table II.1). Five of the top 10 host economies now are

developing ones. However, the increase in developing country

inflows is, overall, primarily a developing Asia

story. FDI inflows to that region grew by 9 per cent

to $465 billion, constituting the lion’s share of

total FDI in developing economies. Africa’s overall inflows

remained flat at $54 billion, while those to Latin

America and the Caribbean saw a 14 per cent decline to $159

billion, after four years of consecutive increases. FDI

to transition economies dropped by more than half

to $48 billion. Inflows to developed economies as a

whole fell by 28 per cent to $499 billion, decreasing

both in Europe and North America. Flows to Europe

fell by 11 per cent to $289 billion, one third of their

2007 peak, while in North America FDI dropped 51 per

cent to $146 billion.

CHAPTER III

Recent Policy Developments and Key Issues - 18 Pages, 1563KB

Countries’ investment policy measures continue

to be predominantly directed towards investment

liberalization, promotion and facilitation. Measures

geared towards investment in sectors important for

sustainable development are still relatively few.

In 2014, according to UNCTAD’s count, 37 countries -

and economies adopted 63 policy measures affecting

foreign investment. Of these measures, 47 related to

liberalization, promotion and facilitation of investment,

while 9 introduced new restrictions or regulations on

investment (table III.1). The share of liberalization and

promotion increased significantly, from 73 per cent in

2013 to 84 per cent in 2014 (figure III.1).

Chapter III -

(Annex tables I and II) - 5 Pages, 317KB

CHAPTER IV - 56 Pages, 1676KB

Growing unease with the current functioning of the

global international investment agreement (IIA) regime,

together with today’s sustainable development

imperative, the greater role of governments in

the economy and the evolution of the investment

landscape, have triggered a move towards reforming

international investment rule making to make it better

suited for today’s policy challenges. As a result,the IIA

regime is going through a period of reflection, review

and revision.

As evident from UNCTAD’s October 2014 World

Investment Forum (WIF), from the heated public

debate taking place in many countries, and from

various parliamentary hearing processes, including

at the regional level, a shared view is emerging on

the need for reform of the IIA regime to ensure that it

works for all stakeholders. The question is not about

whether to reform or not, but about the what, how and

extent of such reform.

CHAPTER V

International Tax and Investment Policy Coherence

- 44 Pages, 1811KB

Intense debate and concrete policy work is ongoing in

the international community on the fiscal contribution

of multinational enterprises (MNEs). The focus is

predominantly on tax avoidance – notably in the

base erosion and profit shifting (BEPS) project. At the

same time, sustained investmentis needed in global

economic growth and development, especially in light

of financing needs for the Sustainable Development

Goals (SDGs). The policy imperative is, and should

be, to take action against tax avoidance to support

domestic resource mobilization and to continue to

facilitate productive investment.

The fiscal contribution of MNEs, or the avoidance

thereof, has been at the centre of attention for some

time. Numerous instances of well-known firms paying

little or no taxes in some jurisdictions despite obviously

significant business interests have led to public protests,

consumer action and intense regulatory scrutiny. Action

groups and non-governmental organizations (NGOs)

have brought to light cases of abusive fiscal practices

of MNEs in some of the poorest developing countries.

Broad support in the international community for

action against tax avoidance by MNEs has led to a

G20 initiative to counter BEPS, led by the Organization

for Economic Co-operation and Development (OECD),

which is the main (and mainstream) policy action in the

international tax arena at the moment.

Chapter V (Annex

I: Establishing the baseline: estimating the fiscal contribution

of multinational enterprises) - 25 Pages, 719KB

Chapter V (Annex

II: An FDI-driven approach to measuring the scale and economic

impact of BEPS) - 28 Pages, 1212KB

Chapter V (Annex

III: Policy action against tax avoidance by MNEs: existing

measures and ongoing discussions) - 8 Pages, 223KB

ANNEX TABLES - 20 Pages, 1073KB

Methodological Note - 60 Pages, 449KB

|